How to Use Restricted Stock Units to Buy a Home in Seattle

This article was originally published on Nov. 24, 2019 under the title “Buying a Home with Restricted Stock Units.” It was updated on September 25, 2025.

Seattle buyers face some of the steepest home prices in the country, and saving enough for a down payment can feel out of reach.

But if you work in tech or a publicly traded company, you may already have a powerful tool in your compensation package: restricted stock units (RSUs).

RSUs are a form of equity compensation that companies often include in a job offer to attract top talent, especially in competitive markets like Seattle.

When structured correctly, RSUs can serve as collateral for restricted stock loans that let you access capital without being forced to sell your shares or miss out on future gains.

For many buyers, this approach makes homeownership in Seattle possible years earlier than saving alone.

In this guide, we’ll break down how restricted stock loans work, how lenders evaluate them, the benefits and risks of using them toward a home purchase, and the key factors to consider before moving forward.

RSUs Explained: How They Work and Why They Matter for Homebuyers

Restricted stock units are a promise from your employer to deliver shares at a later date, typically after certain conditions are met, like staying with the company or hitting performance goals.

Unlike stock options, which let you buy shares at a specified price, you don’t buy RSUs. They’re awarded to you, but you don't fully own the shares right away.

Instead, they follow a vesting schedule, a timeline that dictates when the stock becomes yours.

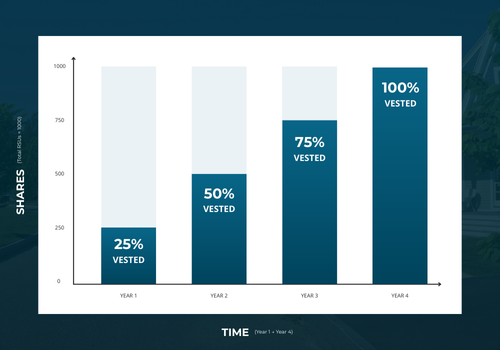

For example:

- You might be granted 1,000 RSUs when you’re hired.

- They vest over four years, with 250 shares vesting each year on your work anniversary.

- After year one, you own 250 shares. By year four, you own all 1,000.

Until those shares vest, you can’t sell or use them as collateral. Typically, you won’t receive dividends or voting rights, either. And if you leave the company early, you may forfeit the unvested portion.

Once vested, RSUs are paid out as shares and are taxable as ordinary income. And if you later sell the stock for more than its market price at vesting, you may also owe capital gains tax.

This combination of vesting rules, taxable events, and ownership rights directly impacts how RSUs can be used for restricted stock loans, and highlights why planning is so important when using RSUs for a home purchase.

What Lenders Really See When You Bring RSUs to the Table

From a lender’s perspective, restricted stock loans are both an opportunity and a risk.

Because RSU values depend on your company’s stock price and market conditions, collateral value can fluctuate.

So when evaluating RSUs, lenders look at more than the stock itself.

They consider your borrower profile and factor in your credit score, income, personal loans, existing debt, and employment history to decide how much they’re willing to lend against your vested stock.

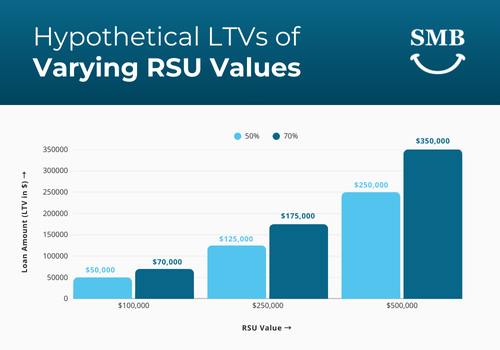

In most cases, lenders only let you borrow a percentage of the shares’ market value, known as the loan-to-value ratio (LTV).

Depending on the loan terms and your credit profile, a lender might allow you to borrow between 50% and 70% of your vested RSUs:

Some lenders may credit RSUs more favorably when qualifying borrowers for jumbo loans, which are common in Seattle's high-cost market. Though these come with stricter underwriting.

The bottom line is that most lenders consider RSUs to be a legitimate form of collateral, but they’ll put in limits and safeguards to protect themselves.

The Hidden Power of Using RSUs for Your Down Payment

This is what makes RSUs such a powerful tool for unlocking liquidity for homebuyers.

They allow you to access capital from your holdings without immediately selling them outright, providing three important benefits for buyers in Seattle’s competitive real estate market:

Faster Path to Homeownership

Instead of waiting years to save enough cash, RSUs can be converted into financing that accelerates your timeline.

Flexibility in Loan Structure

RSU-backed loans can be tailored with favorable interest rates and repayment terms, helping you balance monthly cash flow with other financial goals.

Potential Tax Efficiency

Borrowing instead of selling shares may help defer capital gains and improve long-term tax planning.

These advantages explain why Seattle buyers—especially those in the tech industry—are increasingly exploring restricted stock unit loans as a path to homeownership.

A Smarter Way to Access Your Wealth Without Selling

When lenders let you borrow against your vested RSUs, they typically do it through a stock loan.

These loans all follow the same basic idea we’ve described above: You pledge your vested RSUs (or other stock) as collateral to access liquidity. However, these loans can be structured in different ways depending on the lender.

Non-recourse loans

If you default, the lender can only take the pledged stock. That means your house, savings, or other assets are all protected, but these loans usually come with higher rates or lower LTV ratios.

Margin loans

These loans can offer lower interest rates and quick access to cash, making them appealing for buyers who want flexibility and speed.

However, they’re considered a riskier choice, because if your stock value drops, the lender may demand more collateral or early repayment.

Both non-recourse and margin loan types provide a way to tap into the value of your equity compensation, but each has their own set of costs and risk.

This is why choosing the right loan structure and understanding its impact on your cash flow is critical for Seattle homebuyers.

The Risks You Can't Ignore

To this point, we’ve mostly discussed the benefits of using RSUs for a down payment. And certainly, they can accelerate your path to homeownership.

However, it’s important to understand that these types of loans come with tradeoffs. Before moving forward, here are the key risks every buyer should understand:

Market Risk

RSU values rise and fall with your company’s stock price. A sudden drop in share price could lower the market value of your collateral and even trigger a margin call, requiring you to add more collateral or repay part of the loan balance.

Over-Concentration

Many employees already have significant wealth tied to their employer’s stock. Using those same shares as collateral magnifies that exposure, leaving you vulnerable if the company underperforms.

Loan Structure

As explained above, non-recourse loans limit your liability but cost more. Margin loans may feel cheaper but can call your loan early if markets swing.

Liquidity Limits

Only vested RSUs count as collateral. As a result, the timing of your vesting schedule plays a major role in when and how you can use restricted stock units toward a home purchase.

Compliance Rules

For some early-stage employees, regulations like 'SEC Rule 144' may limit how restricted stock is sold or pledged. While less common for buyers with publicly traded employers, it’s a reminder that compliance matters.

Understanding these risks doesn’t mean avoiding RSU-backed loans altogether. It simply means approaching them with eyes open, a solid plan, and ensuring you work with a lender who understands the risks involved with equity compensation.

Fitting RSUs Into Your Bigger Financial Picture

RSUs are a powerful resource. But they’re only one part of your personal finance picture.

When deciding whether to use restricted stock unit loans for a home purchase, ask yourself:

1. Do the loan terms align with your income, vesting schedule, and cash flow?

2. How does leveraging stock loans affect your long-term investment strategy?

3. Are you balancing the benefits of buying a home sooner with the risks of tying even more wealth to one company?

With home prices consistently climbing year over year, these questions matter.

A well-structured restricted stock loan can help you access a home years sooner, but the right strategy balances short-term opportunity with long-term security.

From Paycheck to Property

In Seattle's high-cost real estate market, saving a traditional 20% down payment often means setting aside $150,000 or more.

For many renters, this is simply too large of a hurdle to overcome.

Restricted stock loans change that equation.

By using RSUs as collateral, they become more than part of your paycheck. RSUs allow you to access capital, compete in a hot market, and start building equity faster.

Of course, investing always involves risk. That’s why the right guidance is essential.

A mortgage broker who understands equity compensation can help structure loan terms, avoid early repayment surprises, and keep your strategy aligned with your financial goals.

Ready to see how your RSUs can help you buy in Seattle?

Start your personalized mortgage plan with Seattle’s Mortgage Broker today.

How Homeowners Can Save More By Cutting Refinance Fees To Avoid

The Ultimate Guide to the Best Suburbs of Seattle

Should You Use a Mortgage Broker? Everything You Need to Know First

How to Find the Right Neighborhoods in Seattle for Your Budget and Lifestyle

Warrantable vs. Non-Warrantable Condos: What Every Buyer Needs to Know Before Financing

How Much Does It Cost to Refinance a Mortgage in Seattle? A Homeowner’s Guide

.png)

How Often Can You Refinance Your Home?

.png)

The Complete Guide to For Sale By Owner (FSBO) in Seattle

10 Questions Every Seattle First-Time Home Buyer Asks

What is a Non-Warrantable Condo?

Ultimate Seattle Mortgage Loan Documents Checklist

Your Complete Guide to Seattle Property Tax

Why You Should Work with a Mortgage Broker

Where to Find the Best Local Mortgage Broker

Where Are The Best Places To Live In Seattle?

What’s the Best Way to Save Money for a House in Seattle?

When is the Best Time to Refinance a Home?

What is the Jumbo Loan Limit in Seattle 2020?

What You Need to Buy a House in Seattle

What Is a Jumbo Loan and will you need one when moving to Seattle?

What is the Jumbo Loan Limit in Seattle?

What Is A Non-Warrantable Condo?

What is the Best Down Payment Amount on a House in Seattle?

What is PMI Mortgage Insurance? And Why It Is Not As Bad As You Think

What Is A Cash-Out Refinance?

What do Home Loan Underwriters Look For?

What Down Payment Do I Need for a House?

What Are The Costs of Buying a Home?

What Are The Best Neighborhoods In Seattle For Families?

FAQ: What Are the VA Home Loan Requirements?

WEST SEATTLE JUNCTION ; Seattle Neighborhood Tour

What are RSUs and How to Spend Them

Understanding Mortgage Down Payments

Top 5 Seattle Suburbs to Buy In 2021

Understanding Down Payments in Seattle

The Ultimate Mortgage Document Checklist

Top 10 Questions To Ask A Mortgage Broker (Before You Commit)

The Worst First-Time Homebuyer Mistakes

The Top 5 Seattle Suburbs for 2020

The Best Seattle Neighborhoods in 2020

How to Find the Best Mortgage Refinance Companies in Seattle

The Best Seattle Neighborhoods for Families

The Best Neighborhoods in Seattle to Buy a Home

The 7 Best Seattle Suburbs for Families

Seattle Neighborhood Guide: The Top 10 Most Affordable Places To Live In Seattle

SOUTH LAKE UNION ; Seattle Neighborhood Tour

Seattle Summer Housing Market Guide 2020

Seattle Housing Market Update 2020

Seattle Housing Market Hacks

Save Money When Buying a House in Seattle

Save Money on Your Mortgage Refinance

Moving to Seattle with a Family? Here's the BEST Suburbs For You!

Refinancing To Reduce Your Bills and Increase Available Cash

Neighborhoods in Seattle to Buy a Home 2020

Real Estate Trends in Seattle

Mortgage Down Payments in Seattle

MAGNOLIA ; Seattle Neighborhood Tour

Mistakes to Avoid with Cash-Out Refinance

How to Refinance Your Home in 9 Steps

Jumbo Loan Limit vs Conforming Loan Limit in Seattle for 2021

KIRKLAND ; Seattle Neighborhood Tour

Jumbo Loan Limit in Seattle for 2021

ISSAQUAH ; Seattle Neighborhood Tour

Is My Credit Score Good Enough to Buy a House?

How to Buy a House; Home Buying 101

How to Lower Your Monthly Mortgage Payment

How to Get the Best Rate for Your Home Loan

How to Buy a House for Less

How Much Home Can I Buy in Seattle?

How Much Do You Really Need for a Down Payment in Seattle?

How Much Home Can I Afford?

Home Price Forecast for Seattle 2020

How Hot is the Seattle Real Estate Market?

How Hot is the Seattle Real Estate Market in 2022?

Home Inspection Questions You Need to Ask

Do You Need a Realtor to Buy a House in Seattle?

FHA vs. Conventional Loan: Which Mortgage Is Right for You?

Find the Best Mortgage Lender for Your Home Loan

Federal Housing Administration Loans 2021

Down Payment Requirements in Seattle

FACTORIA and SOMERSET ; Bellevue Neighborhood Tour

Everything you Need to Know About Seattle Jumbo Mortgages

Everything You Need to Know About VA Loans

Advice To A First Time Home Buyer: Down Payment Assistance Programs Exist for Millennials

CROSSROADS ; Bellevue Neighborhood Tour

Down Payment 101: How Much Money Do I Need to Buy a House?

COVID-19 Mortgage Help for Homeowners

Comparing ARM vs. Fixed Rate Mortgage

Can I Afford To Buy A Home In Seattle?

Choosing the Best Lenders for Home Loans

How to Use Restricted Stock Units to Buy a Home in Seattle

ARM v. Fixed Mortgage: Which is Right For You?

Ballard or Queen Anne? The Best Neighborhoods of Seattle to Buy a House

Avoiding the Worst Seattle Mortgage Lenders

Are You Buying a House in Seattle? Here’s the Ultimate Survival Guide

Fixed vs. Adjustable Rate Mortgage: How Today’s Buyers Can Make A Smarter Choice

ALKI BEACH ;; A Seattle Neighborhood Tour

A Complete Guide to Refinancing Your Home Loan