How Much Do You Really Need for a Down Payment in Seattle?

This article was originally published on August 17, 2023 under the title “How Much Down Payment Do I Need to Buy a House in Seattle?” It was updated on October 01, 2025.

Buying a home always comes with a big question: How much do I need for a down payment?

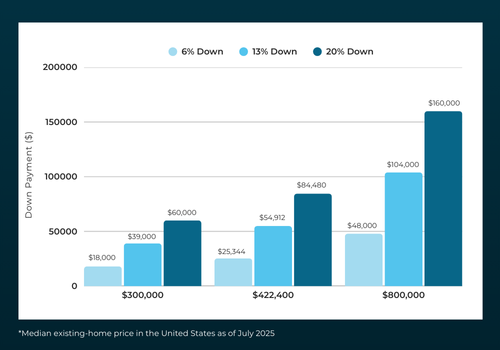

Nationally, the average down payment for first-time buyers is about 7–9% of the purchase price, while repeat buyers often put down 13–15%.

Very few actually reach the 20% mark that many people assume is required.

That’s because 20% isn’t a rule.

It’s just the number that helps you avoid private mortgage insurance (PMI) or mortgage insurance premiums, which get added to your monthly mortgage payment if you put less down.

What does that look like in real dollars?

In Seattle, where the median sale price is far higher than the national average, a $10K or even $20K down payment usually won’t go far without payment assistance programs.

This guide breaks down what buyers should know about the average downpayment of a house in Seattle. In the sections below, we’ll look at everything from loan types and payment assistance to buyer profiles and strategies that let buyers with financing stand toe-to-toe with cash offers.

Why Down Payments Feel Bigger In Seattle

Seattle homebuyers face a unique challenge.

Thanks to tech-driven demand, limited supply, and rising home prices, a down payment percentage that feels manageable elsewhere can be massive here.

For example, 10% on a $885,000 Seattle home, the average price as of August 2025, according to Redfin and Realtor.com, equals $88,500. Even a small 3–5% down payment translates into tens of thousands of dollars.

This is why local governments and state-backed payment assistance programs matter so much for qualified buyers. They help bridge the gap and make ownership possible in one of the nation’s most expensive housing markets.

Breaking Down Minimum Down Payments by Loan Type

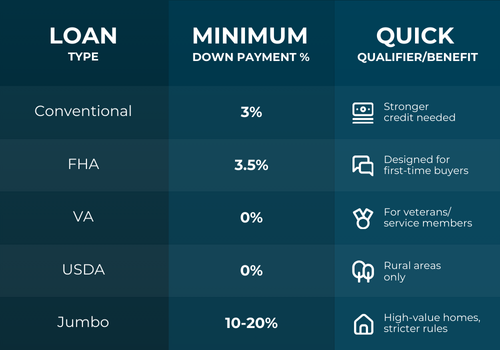

The minimum down payment you need depends on the mortgage loan you qualify for. Here are the most common programs:

Conventional Loans

These loans are flexible, are offered by many lenders, and require as little as 3% down, but they usually demand a higher credit score to qualify. For buyers with strong credit, they can mean lower monthly mortgage payments and less interest paid over time.

FHA Loans

Backed by the Federal Housing Administration, FHA loans require just 3.5% down. Designed for first time homebuyers or those with moderate credit scores, this option remains one of the most widely used mortgage programs in Seattle.

VA Loans

Eligible veterans and active-duty service members can qualify for 0% down through the Department of Veterans Affairs. With no PMI required, VA loans stand out as one of the most affordable mortgage options available.

USDA Loans

Offering 0% down for qualified buyers, these loans are backed by the United States Department of Agriculture. While they aren’t typically used inside Seattle city limits, they provide a valuable path to ownership in rural communities nearby.

Jumbo Loans

High home prices in Seattle often exceed the maximum loan limits, which prevents many buyers from using a standard conforming loan and pushes them into applying for jumbo loans. These loan types require down payments of 10–20% along with stricter underwriting which means buyers need to be prepared for higher upfront costs and tougher approval standards.

While some buyers qualify for 0% options, others may need to plan for 10% or more if their home falls into jumbo loan territory.

Choosing the right loan type impacts more than the size of your down payment. It shapes your mortgage amount, determines whether you’ll pay PMI, and affects how much interest you’ll pay over time.

Understanding which path fits your situation helps you set realistic savings goals and ensures you don’t overestimate or underestimate what it takes to buy in Seattle.

Help For Seattle Buyers: Down Payment Assistance Programs

I know what you’re thinking.

Considering a number like $75,000 for a down payment can make buying a home in Seattle feel completely out of reach.

You’re not alone in thinking that.

But the good news is you don’t always have to cover it on your own.

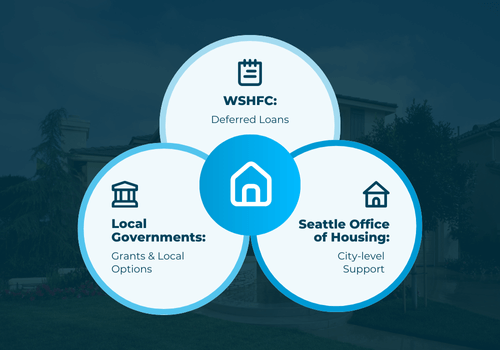

Seattle buyers have access to a range of payment assistance programs designed to reduce what you need upfront. From state-backed loans to city-level support, these programs help qualified buyers move from renting to owning.

Washington State Housing Finance Commission (WSHFC)

Deferred loans from this state program can cover part of your down payment on a house.

No payments are due until the home is sold or refinanced, which means you can focus on your mortgage payments without juggling extra debt.

For many first time buyers, it’s the difference between waiting years and buying a home sooner.

Seattle Office of Housing Programs

City-backed programs provide support for income-qualified buyers purchasing within Seattle limits.

These programs help keep Seattle residents in the city even as home prices climb, reducing the barrier for younger buyers entering the market.

Local Governments

Occasionally, local governments introduce grants or special payment assistance programs to expand access to loans for first-time home buyers.

While smaller in scale than state or city options, these can combine with other programs to provide enough money to meet minimums.

In a high-cost market like Seattle, these programs can be the difference between continuing to rent and finally owning a home. By lowering upfront requirements, they make homes accessible to more qualified buyers.

The Hidden Costs of Buying a Home in Seattle

When planning for a home purchase, it’s easy to focus only on the down payment.

But that’s just one piece of the financial puzzle.

Seattle buyers should also factor in several other costs that play a big role in affordability—both at closing and long after you move in:

Private Mortgage Insurance (PMI)

PMI is required when you put less than 20% down. While it raises your monthly payment, it also allows you to buy years earlier instead of waiting to save a larger down payment, a tradeoff many first-time buyers find worthwhile.

Closing Costs

Closing costs usually range from 2–5% of the purchase price. On a $600,000 home, that’s an additional $12,000–$30,000 due at closing, covering expenses such as appraisals, title fees, and lender charges.

Emergency Fund

Owning a home means being ready for the unexpected—from roof repairs to broken appliances. Keeping savings set aside can prevent those surprises from turning into financial stress.

Local Property Taxes

Property taxes in Seattle vary depending on the neighborhood. These ongoing costs directly affect your monthly affordability and should be included in your overall budget from the start.

Looking at the down payment alone can create a false sense of readiness.

These additional expenses shape your real budget, and failing to plan for them can derail your purchase or add pressure after you move in. To see how all the moving pieces of a mortgage fit together—from closing costs to long-term payments—explore our free step-by-step homebuying guide.

The Bottom Line for Buyers

By budgeting for PMI, closing costs, taxes, and an emergency cushion, you’ll get a more accurate picture of what homeownership really costs. The good news: planning ahead puts you in control, helping you buy with confidence instead of stress.

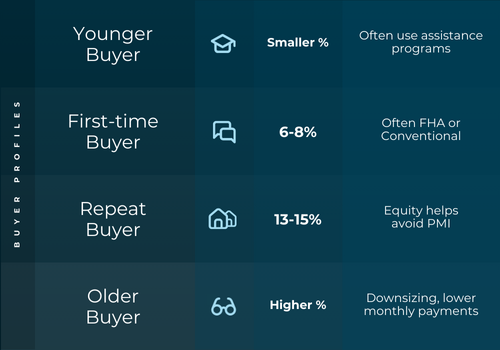

Buyer Profiles: Who Puts Down What

Earlier we looked at national averages. Now, let’s see how different age groups and buyer types approach a down payment on a house in Seattle.

First-Time Homebuyers

Since saving while renting in Seattle can be tough, first-time homebuyers often plan for smaller down payments, usually in the 6–8% range, with many relying on FHA or conventional programs that allow lower minimums.

Repeat Buyers

By using equity from their previous home, repeat buyers tend to have more flexibility, averaging 13–15% for a down payment. This strengthens their offers and helps them avoid PMI and pay less over the life of their loan.

Older Buyers

Retirement savings or proceeds from downsizing often fund higher down payments. This reduces the mortgage amount and provides lower monthly mortgage payments, a benefit that can be especially appealing at this stage of life.

Younger Buyers

Smaller down payments are typical of younger buyers. But while these buyers may bring the lowest median down payments, assistance programs like the FHA or state programs, help them bridge the gap and stay competitive.

Take a household earning $70,000 per year.

Depending on debt and credit score, they might qualify for a home in the $280,000–$300,000 range. A 10% down payment equals about $28,000–$30,000 upfront. That’s a stretch, but achievable with planning, equity from repeat purchases, and the right loan program.

At the end of the day, averages only tell part of the story for home buyers. Knowing where you fall helps you set realistic goals and explore the programs that can support your path to ownership without sending more money than needed.

How to Compete Without 20% in Seattle

By now, it’s clear that many Seattle buyers no longer stick to the once-standard 20% down payment. But the market is still fiercely competitive—homes sell fast, often with multiple offers.

And in that kind of environment, the more cash you can put forward upfront, the stronger your offer looks. Sellers see cash as certainty: fewer financing risks, fewer delays, fewer reasons a deal might fall apart.

This creates a challenge without a huge down payment saved: How can you stand out against offers that look more secure on paper?

The good news is that sellers don’t always choose the highest number on paper. What they want most is certainty: confidence that the deal will close smoothly and on time. That means home buyers with financing can go head-to-head with cash offers if they show they’re prepared.

To compete:

Get Fully Pre-Approved or Underwritten

A strong pre-approval tells sellers your financing is already vetted. Full underwriting goes a step further, removing doubts about whether the mortgage loan will close.

Work With a Broker

Unlike a single bank, brokers shop multiple lenders—including private lenders—to find competitive rates and terms. This flexibility can help save you interest paid over the life of the loan and craft terms that fit both your budget and what sellers value most.

Present a Clean Offer

The fewer the contingencies, the stronger the offer looks. Pairing this with the ability to close fast, sometimes in as little as eight days, can outweigh a competing bid with a higher down payment.

.png)

The bottom line, home buyers don’t need a 20% down payment to be competitive in Seattle's housing market.

With the right preparation and a broker who can navigate mortgage lenders and home loans, you can build an offer that gives sellers confidence and gives you the edge without overpaying.

Let Seattle’s Mortgage Broker Be Your Guide

In Seattle, saving 20% for a down payment on a house isn’t realistic for most home buyers.

But the good news is that it isn’t required.

Across the country, people are buying homes with much less, and here in Seattle, local programs and smart loan options make ownership possible even in this high-cost market.

With the right loan, the right assistance, and the right approach, you can buy with far less than 20% down and still make a competitive offer.

Ready to find out what’s realistic for you? Start your personalized mortgage plan with Seattle’s Mortgage Broker today.

How Homeowners Can Save More By Cutting Refinance Fees To Avoid

The Ultimate Guide to the Best Suburbs of Seattle

Should You Use a Mortgage Broker? Everything You Need to Know First

How to Find the Right Neighborhoods in Seattle for Your Budget and Lifestyle

Warrantable vs. Non-Warrantable Condos: What Every Buyer Needs to Know Before Financing

How Much Does It Cost to Refinance a Mortgage in Seattle? A Homeowner’s Guide

.png)

How Often Can You Refinance Your Home?

.png)

The Complete Guide to For Sale By Owner (FSBO) in Seattle

10 Questions Every Seattle First-Time Home Buyer Asks

What is a Non-Warrantable Condo?

Ultimate Seattle Mortgage Loan Documents Checklist

Your Complete Guide to Seattle Property Tax

Why You Should Work with a Mortgage Broker

Where to Find the Best Local Mortgage Broker

Where Are The Best Places To Live In Seattle?

What’s the Best Way to Save Money for a House in Seattle?

When is the Best Time to Refinance a Home?

What is the Jumbo Loan Limit in Seattle 2020?

What You Need to Buy a House in Seattle

What Is a Jumbo Loan and will you need one when moving to Seattle?

What is the Jumbo Loan Limit in Seattle?

What Is A Non-Warrantable Condo?

What is the Best Down Payment Amount on a House in Seattle?

What is PMI Mortgage Insurance? And Why It Is Not As Bad As You Think

What Is A Cash-Out Refinance?

What do Home Loan Underwriters Look For?

What Down Payment Do I Need for a House?

What Are The Costs of Buying a Home?

What Are The Best Neighborhoods In Seattle For Families?

FAQ: What Are the VA Home Loan Requirements?

WEST SEATTLE JUNCTION ; Seattle Neighborhood Tour

What are RSUs and How to Spend Them

Understanding Mortgage Down Payments

Top 5 Seattle Suburbs to Buy In 2021

Understanding Down Payments in Seattle

The Ultimate Mortgage Document Checklist

Top 10 Questions To Ask A Mortgage Broker (Before You Commit)

The Worst First-Time Homebuyer Mistakes

The Top 5 Seattle Suburbs for 2020

The Best Seattle Neighborhoods in 2020

How to Find the Best Mortgage Refinance Companies in Seattle

The Best Seattle Neighborhoods for Families

The Best Neighborhoods in Seattle to Buy a Home

The 7 Best Seattle Suburbs for Families

Seattle Neighborhood Guide: The Top 10 Most Affordable Places To Live In Seattle

SOUTH LAKE UNION ; Seattle Neighborhood Tour

Seattle Summer Housing Market Guide 2020

Seattle Housing Market Update 2020

Seattle Housing Market Hacks

Save Money When Buying a House in Seattle

Save Money on Your Mortgage Refinance

Moving to Seattle with a Family? Here's the BEST Suburbs For You!

Refinancing To Reduce Your Bills and Increase Available Cash

Neighborhoods in Seattle to Buy a Home 2020

Real Estate Trends in Seattle

Mortgage Down Payments in Seattle

MAGNOLIA ; Seattle Neighborhood Tour

Mistakes to Avoid with Cash-Out Refinance

How to Refinance Your Home in 9 Steps

Jumbo Loan Limit vs Conforming Loan Limit in Seattle for 2021

KIRKLAND ; Seattle Neighborhood Tour

Jumbo Loan Limit in Seattle for 2021

ISSAQUAH ; Seattle Neighborhood Tour

Is My Credit Score Good Enough to Buy a House?

How to Buy a House; Home Buying 101

How to Lower Your Monthly Mortgage Payment

How to Get the Best Rate for Your Home Loan

How to Buy a House for Less

How Much Home Can I Buy in Seattle?

How Much Do You Really Need for a Down Payment in Seattle?

How Much Home Can I Afford?

Home Price Forecast for Seattle 2020

How Hot is the Seattle Real Estate Market?

How Hot is the Seattle Real Estate Market in 2022?

Home Inspection Questions You Need to Ask

Do You Need a Realtor to Buy a House in Seattle?

FHA vs. Conventional Loan: Which Mortgage Is Right for You?

Find the Best Mortgage Lender for Your Home Loan

Federal Housing Administration Loans 2021

Down Payment Requirements in Seattle

FACTORIA and SOMERSET ; Bellevue Neighborhood Tour

Everything you Need to Know About Seattle Jumbo Mortgages

Everything You Need to Know About VA Loans

Advice To A First Time Home Buyer: Down Payment Assistance Programs Exist for Millennials

CROSSROADS ; Bellevue Neighborhood Tour

Down Payment 101: How Much Money Do I Need to Buy a House?

COVID-19 Mortgage Help for Homeowners

Comparing ARM vs. Fixed Rate Mortgage

Can I Afford To Buy A Home In Seattle?

Choosing the Best Lenders for Home Loans

How to Use Restricted Stock Units to Buy a Home in Seattle

ARM v. Fixed Mortgage: Which is Right For You?

Ballard or Queen Anne? The Best Neighborhoods of Seattle to Buy a House

Avoiding the Worst Seattle Mortgage Lenders

Are You Buying a House in Seattle? Here’s the Ultimate Survival Guide

Fixed vs. Adjustable Rate Mortgage: How Today’s Buyers Can Make A Smarter Choice

ALKI BEACH ;; A Seattle Neighborhood Tour

A Complete Guide to Refinancing Your Home Loan